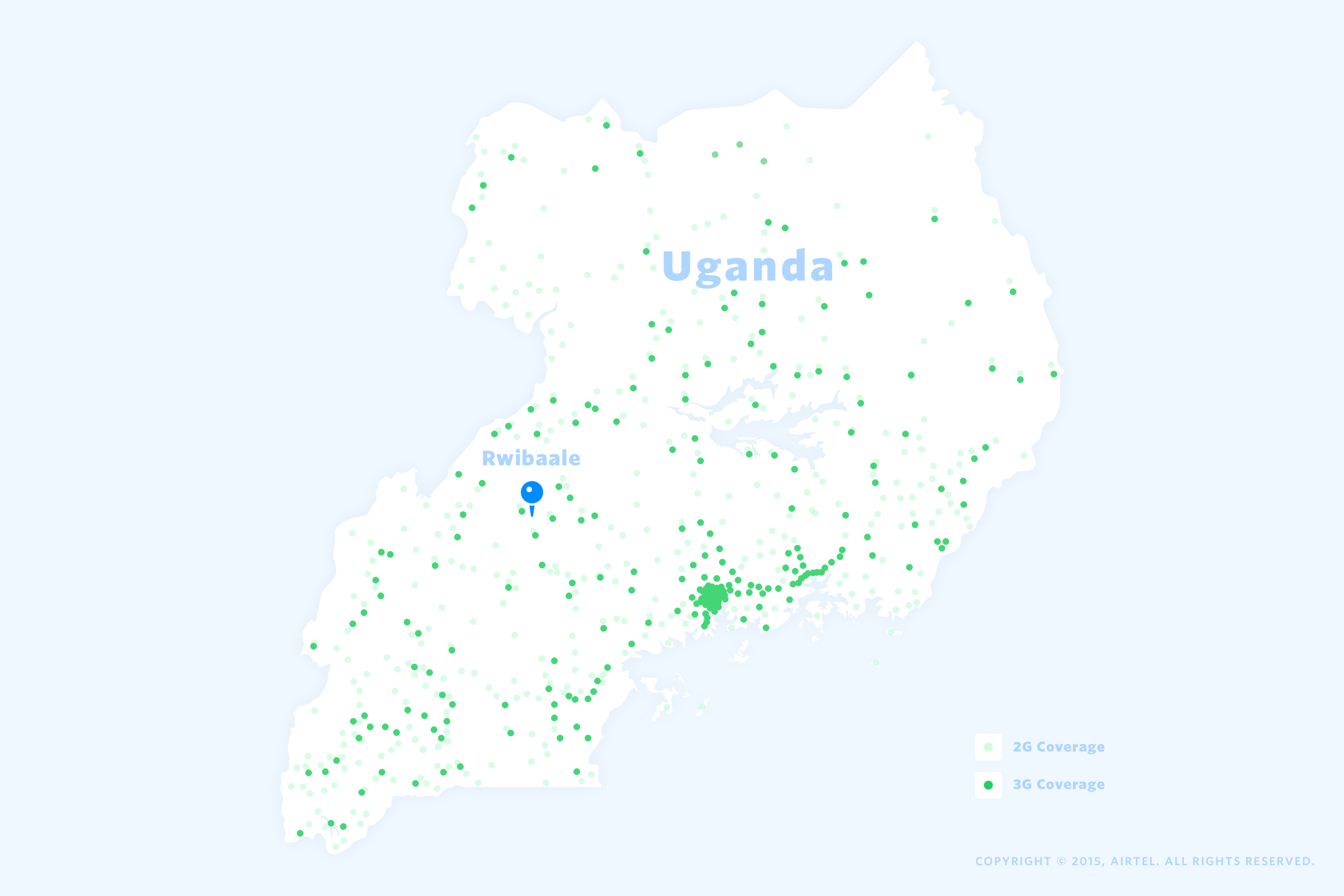

After nearly thirty hours of flying through three airports and a four-hour drive down bumpy dirt roads, our product team made it from our office in San Francisco to Rwibaale, the rural community in western Uganda. This is where we built Watsi Coverage, our community-based health insurance platform.

The long journey dissolved any expectation that designing and developing technology for use in Rwibaale would be anything like doing it for use in San Francisco.

Stripped of reliable electricity, WiFi, and communication channels back home, our team immersed themselves in the local environment for twelve weeks while they built a platform that could succeed in this challenging setting.

Challenge #1:

How do you power an entire health coverage system when there is no traditional infrastructure?

Mobile data

In the US, our telecommunications infrastructure (phone lines, cable TV, fiber optics) makes accessing the internet as easy as knowing a network name and password. In Rwibaale, the infrastructure required for those types of internet connections doesn’t exist. Instead, the internet is only accessible through cell phones and mobile hotpots.

Uganda’s cellular network created an efficient system for an individual mobile phone users to access the community's 3G network. All mobile plans in Uganda are pay-as-you-go. Data is typically purchased 1MB at a time from a handful of stores in town and can be shared between SIM cards.

But that system broke down when we tried to use it to power an entire health coverage platform. To operate internet for the clinic, the mobile phones used for field enrollment, our cell phones, and our laptops, we needed a way to purchase 150GB – an amount which far exceeded the local inventory.

Initially, we had to travel to Kampala to visit one of the only vendors in the entire country who could sell over 100GB of data at a time. Uganda is a cash-based economy, so we carried $1.5M Uganda shillings, or $450 USD, with us to make the purchase.

Eventually, we found a more sustainable solution – a remittance service that allowed us to purchase data by sending money directly from our US bank account to our mobile phones. This eliminated the need for long travel days and cash transactions just to keep the system online.

Challenge #2:

How do you authenticate users without relying on emails and passwords?

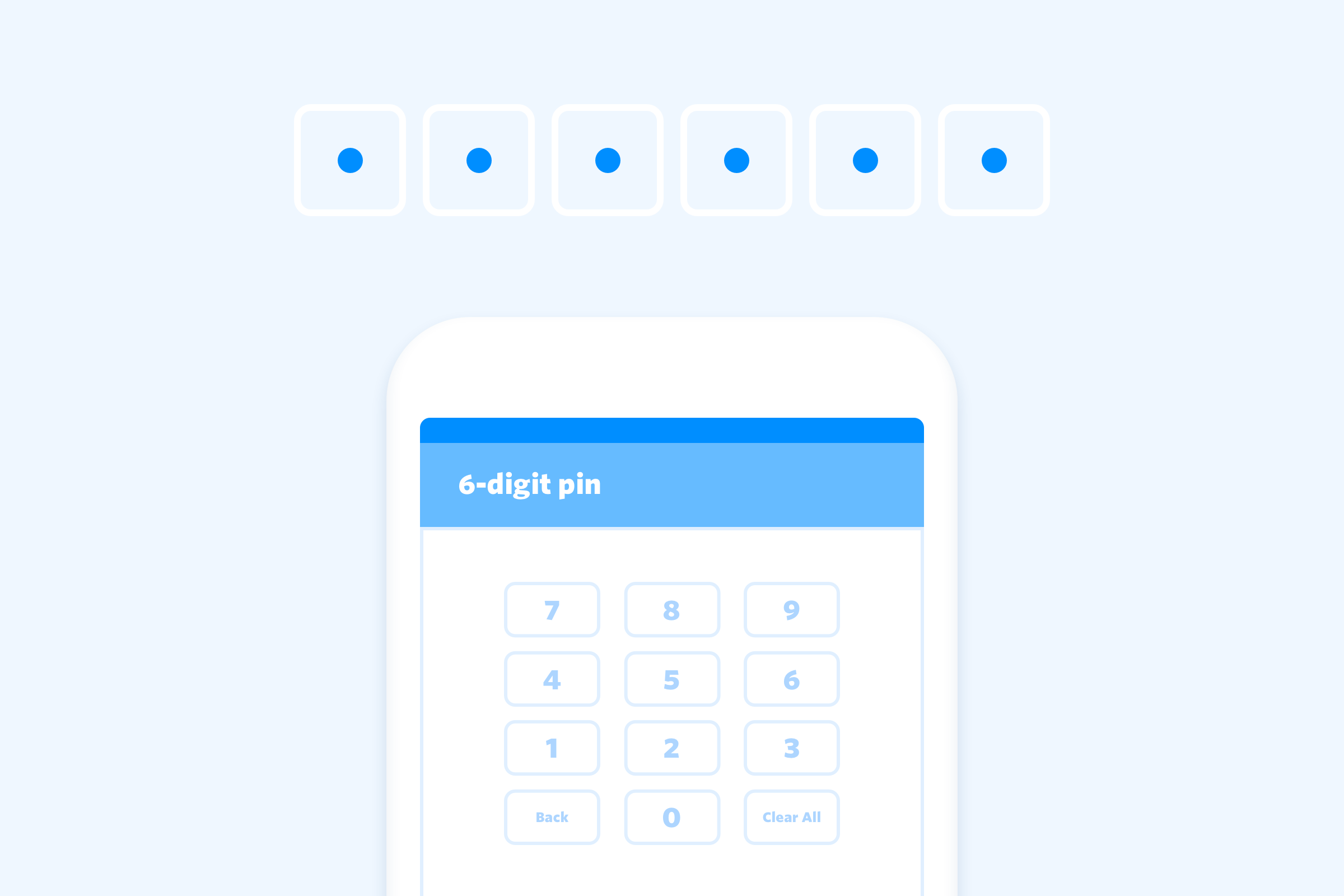

6-digit PINs

In the US, when we sign up for a new service, we use our email and create a password. However, despite being fluent with mobile technology, most members of the clinic staff and the enrollment officers who needed to use our mobile app don’t have email addresses.

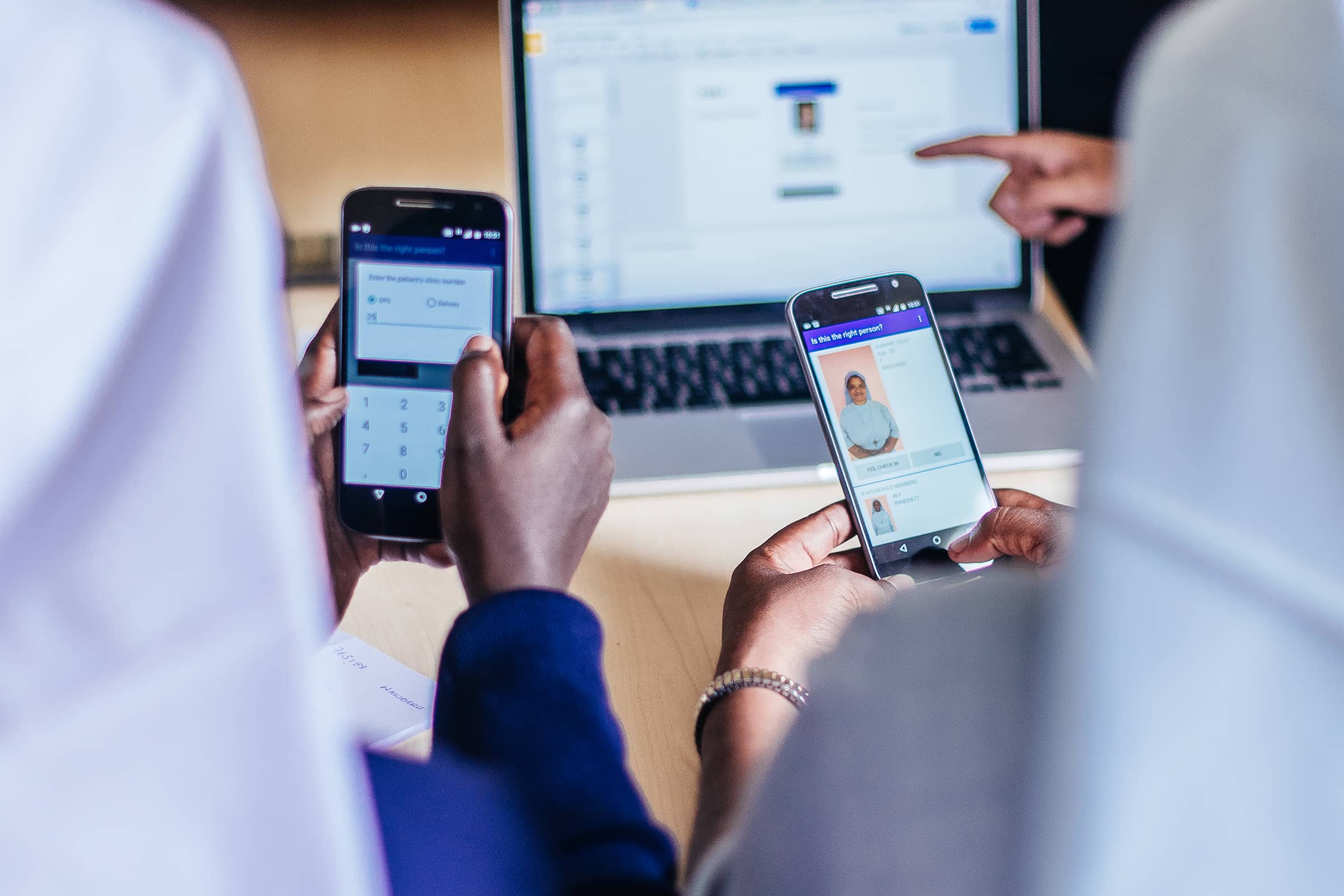

We needed to keep track of who was logging and submitting data, as well as accessing patient information. But in this environment, we had find a way to authenticate users that wouldn’t require the adoption of email.

After sitting side by side with the clinic and enrollment staff, we noticed that they all used Airtel Money – a popular mobile money transfer service in Uganda. Airtel Money uses 4-digit PINs to authenticate users, so we implemented a similar system of 6-digit PINs. Watsi PINs enabled us to quickly onboard dozens of users, successfully gate access, and monitor logins.

The training pitch was as simple as the “Uber for tacos” analogies we overhear in San Francisco every day: It’s an Airtel Money PIN for Watsi Coverage.

Challenge #3:

How do you create a health coverage system that works even if the cell tower is down?

Design offline-first

Most of the time, our San Francisco-based team can take internet access for granted. That’s not the case in Rwibaale, where the internet is dependent upon a cell tower, which needs either electricity or a generator to operate. In order to ensure that our health coverage system didn’t stop working when the internet did, we had to architect our technology to be offline-first.

First, we loaded our app onto rugged Android phones. With 16GB of storage, we were able to store all the relevant data (member names, ages, photos, and health services received) locally on each phone. The user, typically a clinic administrator or an enrollment officer, doesn’t even need to know whether a phone is on or offline because the app behaves the same either way.

In the event of a cell tower outage, as soon as the phone is reconnected to the internet, the data automatically syncs and logs two timestamps – when the information was collected and when it was uploaded. These two pieces of information enable us to maintain data quality despite outages.

As we continue to scale Watsi Coverage, these solutions will evolve, but we're confident that our approach of immersive design and development is the only way to yield technology as resilient and adaptive as the place it was born.

Brigitte Bradford

Director of Marketing